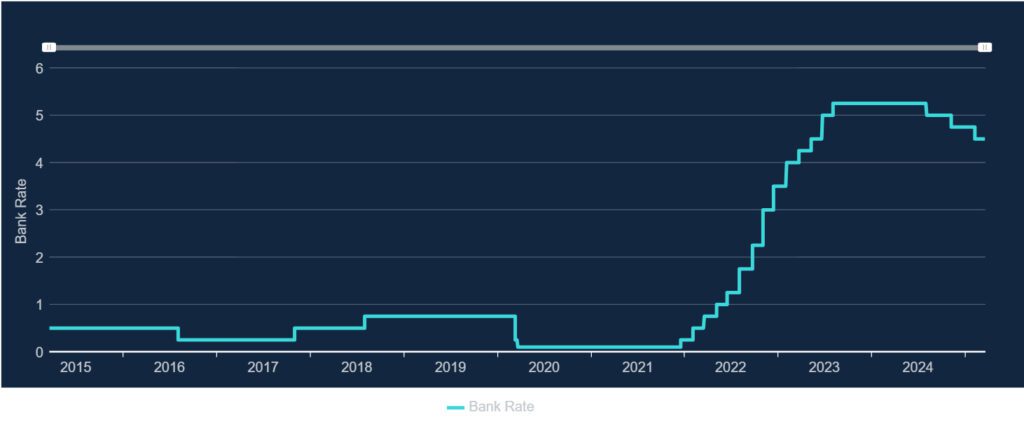

March 2025 Bank of England Base Rate Held

Today the Bank of England held the base rate of interest at 4.5% and indicated that any rate cuts may not happen until August. For some this was seen as a cautionary approach, but the UK economy is still facing inflationary pressures, currently at 3% compared to the Bank of England target of 2%.

Reducing interest rates would allow less money to be spent servicing debt and more money to stimulate the economy, but it comes with a risk that inflation will rise, moving further from the bank’s target.

Inflation is also under threat due to proposed tariffs on various goods and as those costs filter down to the prices consumers pay, inflation could rise despite the static interest rates.

The US Federal Reserve has also chosen to leave interest rates unchanged.

In the coming weeks Rachel Reeves is expected to bring in the proposed increases to Employers National Insurance Contributions.

Where does this leave us all?

For those investing or developing property the market conditions are more favourable than last year, with reduced build costs, more realistic asking prices for property and land, and keener lending rates as the long term expectation is for base rates to drop.

For those re-modelling or extending their home, the keener mortgage rates will keep the monthly payments down, coupled with many lenders now providing mortgages for more years as the state pension age has moved up to 67.

Either way, the excellent design team at MB Architecture with their design flair, combined 70 years of experience, high approval rates, design flair, technical expertise and of course our approved supply chain, will help to ensure your project is a success.

If you would like to discuss your next project with us click the button below to go to our contact page. From there you can either book a free video call with us, e-mail us, or alternatively phone us on 01483 363 065 to get the discussion started!

MB Architecture – Your Design Partner